Contract Issues

Settling-In Allowance

What is it?

This is a lump sum designed to cover expenses associated with the settling-in of an international employee into a new location.

Who is eligible?

Any tenure-track or a postdoc hire.

When is it paid?

Within 3 weeks of the work agreement coming into effect.

What documents do I need to provide to receive it?

You need to have a Russian bank account to be able to receive the settling-in allowance.

Is it taxable?

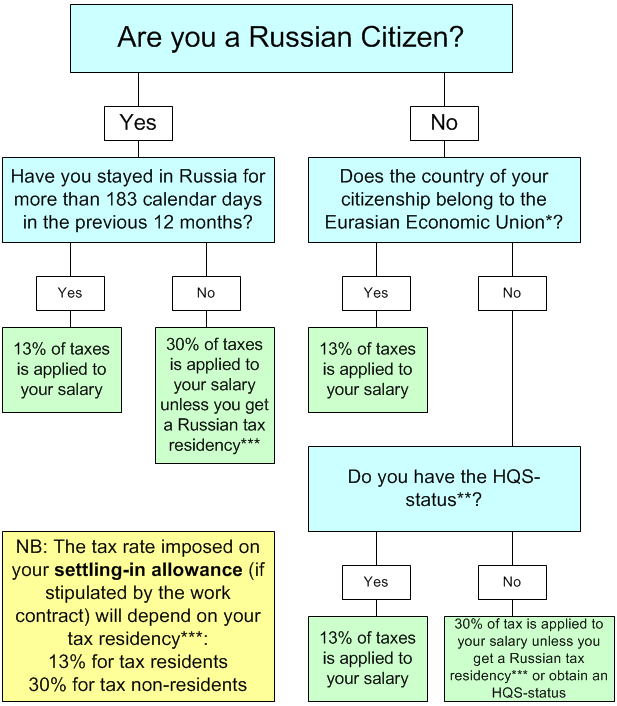

Yes. Taxes applied to this sum depend on one’s tax residency status.

Taxation

HQS work permit can be annulled on a number of reasons, including absence of a foreign national on the territory of Russian Federation for 6 months and more.

Taxes applied to other payments

HQS status does not automatically give an employee the right to a 13% tax rate, as applied to other payments such as settling-in allowances. Whether it is a 13% or 30% tax rate will fully depend on the tax status of the resident. A tax resident is a citizen of any nation who has lived on the territory of the Russian Federation for at least 183 days within the last 12 months. A 13% tax rate shall be applied to the income and other payments of Russian tax residents, whereas the tax rate for non-resident individuals comes to 30%.

Tax deduction and tax filing

All taxes are deducted from your salary automatically by the employer. It means that the sum you receive is your salary after taxes. It also means that you will not have to file taxes in Russia.